Consumer preference for case-ready fresh meats—those packaged off-site rather than at store level—has been growing for the past two decades. Meanwhile, more is expected of those packages from consumers, including sustainability, transparency, and flexibility. Digital and smart packaging technologies are playing their part, enabling meat processors to tell their story to their customers about how their meeting those demands.

This week at the International Production & Processing Expo (IPPE), a show focused on the protein sector, a panel of executives from Sealed Air gathered to discuss these topics, highlighting results of the company’s latest National Meat Case Study and how those trends are shaping meat packaging for traditional grocery stores as well as e-commerce.

Sealed Air executives meet at IPPE to discuss case-ready meat packaging trends.

Sealed Air executives meet at IPPE to discuss case-ready meat packaging trends.

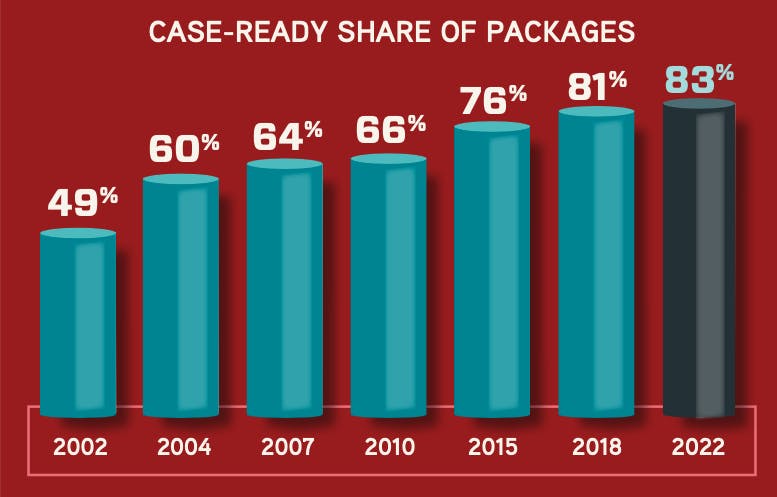

The National Meat Case Study, which has been sponsored by Sealed Air and its Cryovac brand since 2002, has shown a steady trend upward for case-ready fresh meat. Starting at 49% of the market 20 years ago, case ready’s share has grown to 83% in the 2022 study, according to Stacey Couch, marketing development director retail and e-commerce for Sealed Air.

Sealed Air

Sealed Air

“That echoes across all of the proteins,” she adds, noting that turkey and chicken case-ready packaging has grown to almost 100% (99% and 96%, respectively). Beef is the protein most likely to be cut in store, but case-ready here has nonetheless increased to 71% of packages from 66% in 2018.

There are some key trends influencing this growth, including sustainability and labor issues. Like everywhere else, grocers are not immune to labor issues, and case-ready meats provide an alternative to hiring skilled butchers.

“There’s a move away from full-service cases that are so labor-intensive to self-service,” Couch comments.

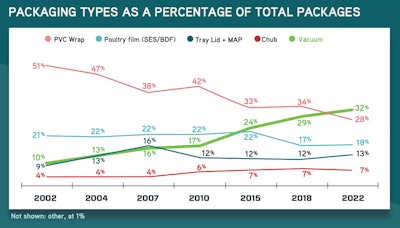

Vacuum packaging takes over lead

Vacuum packaging, in its various forms, has been on a steady incline—in direct relation to the decline of PVC wrap, the type of cling wrap typically used at store level. When Sealed Air began doing this study 20 years ago, PVC wrap accounted for more than half of the packages sold at store level, and vacuum packs accounted for only 9%. In the 2022 study, vacuum packaging took over the No. 1 spot, with 32% of the total, while PVC wrap continued its decline to 28%.

Sealed Air

Sealed Air

Vacuum packages include those that use rollstock, including saddle packs, as well as shrink bags and vacuum skin. “Vacuum packaging just continues to grow,” Couch says. “We can see vacuum increase on virtually every commodity.”

Inflation is on everyone’s mind, with consumers experiencing double-digit inflation on food, proteins in particular, notes Shawn Harris, Sealed Air’s executive director of marketing, Americas proteins. “Vacuum packaging offers an opportunity to buy in bulk and store meat for longer.”

Whether fresh or frozen, vacuum packaging contributes to less food waste, according to Couch. “With food inflation where it’s been, food waste will continue to be top of mind for consumers.”

Smart packages

The case-ready package provides considerable opportunities for the brand owner to not only provide a more sustainable and durable package, but also to use that real estate to convey a wide range of messaging to the consumer, including traceability of where that product’s been and how long it’s been on the shelf, says Nathan Henson, director of global smart packaging for Sealed Air.

Processors can communicate the value of the package or how it can be recycled, for example, Henson says. “The package can help tell the sustainability story that the brand is trying to get across; where their goals are going, with overall initiatives.”

In terms of sustainability, consumers are thinking about food waste, and also about whether the package is recyclable, source-reduced, or if can be reused in some way, Harris says. “If you’re making a change in your packaging material, what a great way to communicate that directly with them,” he says. “You can tell your own story.”

Meanwhile, consumers using their phones to scan QR codes on the package to learn more, or get recipes or coupons, brings another benefit to the meat company. “We’re capturing tons and tons of data that can allow the brands to make informed decisions about what’s resonating with customers,” Henson says.

By scanning QR codes on smart packaging, consumers can find a range of information, including product details and coupons.

By scanning QR codes on smart packaging, consumers can find a range of information, including product details and coupons.

Digital printing has a large role to play in bringing a more dynamic message to consumers on that meat package, Henson adds. “It can take something that is static and create a unique advantage,” he says.

Whereas commercial printing requires large minimum orders, with lots of labor and lots of waste, Henson says, digital printing provides flexibility.

“One of the biggest things that digital printing can do, especially for brand owners, is minimize the obsolescence risk,” Harris says.