We can thank rampant inflation for our thinning wallets every time we go to the grocery store. But what if you could own shares in the companies raising prices?

Inflation’s impact on the economy leaves stocks in food production, agriculture and retail well positioned to benefit from the rising prices. But you need to make sure the stocks you pick are fundamentally sound and have improving earnings. Thanks to Zacks Rank and other screening methods I was able to identify three very compelling food industry stocks to consider buying in 2023.

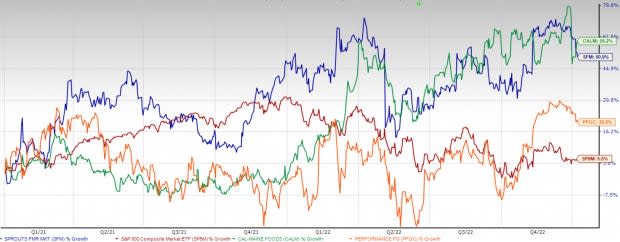

Cal-Maine Foods CALM, the largest producer of eggs in the US, Sprouts Farmers Market SFM, a rapidly growing, healthy, organic focused retail and online grocer, and Performance Food Group PFGC, a food service, snacking and pre-packaged convenience food distribution behemoth. Impressively all three stocks have outperformed the S&P 500 over the last two years and look primed for further gains even in this challenging environment.

Image Source: Zacks Investment Research

CALM

Cal-Maine Foods, the largest producer of eggs in the US is famous for its Land O’ Lakes and Egg-Lands Best brand of eggs. CALM is an extremely sound business with strong prospects.

Founded in 1957, Cal-Maine Foods has evolved into a national brand selling its products in all major US markets. CALM is vertically integrated and controls production, grading, packaging, marketing, and distribution with a mission to be the most sustainable and consistent supplier of fresh shell eggs in the country.

Eggs especially have not escaped the pressures of inflation and prices are up a whopping 49%. But this hasn’t stopped people from continuing to purchase them as eggs an absolute staple for American households.

CALM earns a Zacks Rank #1 (Strong Buy), alongside A grades for Value, Growth, and Momentum in our style scores system. In terms of Zacks stock filters this is about as good as it gets. Furthermore, Cal-Maine Foods has a very reasonable PE ratio under 10, and currently sports a dividend yield of 3%. Plus, its stock price is pushing all-time highs even after the market fell in 2022

SFM

Sprouts Farmers Market is a supermarket chain that offers a wide selection of natural and organic food and food products. SFM has 380 stores in 23 states and employs 35,000 people.

Unless you live under a rock you may have noticed that food and grocery shopping trends are undergoing some rapid and major changes. Preferences for healthy, organic, and sustainable products are becoming a requirement for many shoppers and Sprouts product suite is on the cutting edge of consumer preferences.

Additionally, this segment of shoppers is usually in a higher income bracket and should be less sensitive to any future economic weakness. This is a major point because although inflation is changing grocery shopping patterns, niche diet consumers like keto, vegan, paleo, and organic focused shoppers are a much stickier and higher income group.

Sprouts Farmers Market scores quite well with a Zacks Rank #2 (Buy), and like CALM, scores a triple A across Value, Growth and Momentum. Sprouts has grown its revenue from $512 million in 2010 to $6.3 billion TTM revenue and has an estimated long-term earnings growth rate of 7.3%. With a growing emphasis on their e-commerce platform, increasing reach, and higher margin private label products they are well on their way to reaching that forecast.

PFGC

With a 100-year history and $50 billion in sales, Performance Food Group is a stock worth putting on your watchlist. PFGC operates in three main segments: foodservice distribution – delivering ingredients to thousands of restaurants, snacking products distribution, and convenience, which distributes packaged prepared foods.

PFGC has a Zacks Rank #2 (Buy), alongside A grade for Value, and Growth, and a B for Momentum. These scores alone are compelling reasons to look at the company. Additionally, PFGC has a very reasonable Price to Sales ratio of 0.18, well below the food wholesalers’ average of 0.37 and has recently been upgraded by several major financial institutions.

Conclusion

Although the broad market is going through some challenging times there are still stocks to buy. Here we are looking at relative stock price leaders, retail product innovators, commodity producers, and distributors. Using stock screeners and a discerning eye it is still possible to find good companies for the current market.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CalMaine Foods, Inc. (CALM) : Free Stock Analysis Report

Sprouts Farmers Market, Inc. (SFM) : Free Stock Analysis Report

Performance Food Group Company (PFGC) : Free Stock Analysis Report