The Zacks Containers – Paper and Packaging industry is currently facing the impact of the ongoing supply-chain disruptions and rising costs. Lower consumer spending amid an inflationary backdrop has lately decelerated demand. Nevertheless, the industry’s demand will be supported by the rising e-commerce activities and solid demand for sustainable and eco-friendly packaging options due to increasing environmental concerns. Pricing actions implemented by the industry players will help them counter the impact of high costs.

Despite the odds, AptarGroup ATR, Graphic Packaging Holding Company GPK and Karat Packaging KRT are set to gain from growth efforts.

About the Industry

The Zacks Containers – Paper and Packaging industry comprises companies that manufacture paper and plastic-packaging products. The packaging solutions provided by the industry help protect and preserve products, extend the shelf life and cut down on wastage and loss across the wide and lengthy range of distribution channels. The products range from containerboard and corrugated packaging to flexible and rigid plastic packaging. Some companies manufacture dispensing pumps, closures, aerosol valves and applicators for the beauty, personal, home care and healthcare markets. The industry serves a wide array of markets, including food, beverage, food services and other consumer products, such as beauty, personal care and home care. They also cater to the chemical, agribusiness, medical, pharmaceutical, electronics and industrial markets, to name a few.

What’s Shaping the Future of the Containers – Paper and Packaging Industry

High Costs & Supply-Chain Woes Remain: The industry participants continue encountering supply-chain disruptions and higher raw material costs, stemming from various factors like general inflationary pressure, limited availability of certain raw materials, and global transportation disruptions. Higher labor, transportation and chemical costs aggravated their woes. Shortage of labor impacted their production levels and impaired their ability to meet high demand. The companies have been implementing cost-reduction actions for a while, which are likely to sustain margins. They focus on streamlining their operations and realigning with high-growth key markets to bolster their performances. Some companies recently witnessed a decline in volumes due to lower consumer spending on goods, given the inflationary scenario.

E-commerce Remains a Key Catalyst: With rising e-commerce activities over the past few years and the pandemic accelerating it further, the importance of packaging increased manifold as it maintains the integrity and durability of a product. Packaging also helps to withstand the complex product-delivery process. Per Statista, global retail e-commerce sales amounting to $5.2 trillion in 2021 are expected to surge 56% to $8.1 trillion by 2026. This, in turn, will fuel the Containers – Paper and Packaging industry. The industry has significant exposure (more than 60%) to consumer-oriented end markets, such as food and beverages and healthcare, keeping demand for packaging applications fairly stable across economic cycles.

Focus on Eco-Friendly Packaging Intensifies: Demand for environmentally-friendly biodegradable packaging materials is witnessing s a steady rise globally, courtesy of customers’ increasing awareness of environmental issues. The industry is constantly striving to meet the same by adopting new technology and bringing innovative products. Industry players already began incorporating recycled content into production methods. By maximizing recycling, the industry can implement environmentally and economically-sustainable production methods.

Industry Rank

The Zacks Containers – Paper and Packaging industry is an 11-stock group within the broader Zacks Industrial Products sector. The industry currently carries a Zacks Industry Rank #173, which places it at the bottom 31% of the 250 Zacks industries.

Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1. Looking at the aggregate earnings estimate revisions, it appears that analysts are gradually losing confidence in this group’s earnings growth potential. Over the past six months, the industry’s earnings estimate for the current year has gone down 9%.

Before we present a few Containers – Paper and Packaging stocks that you may want to consider for your portfolio, let’s look at the industry’s recent stock-market performance and the valuation picture.

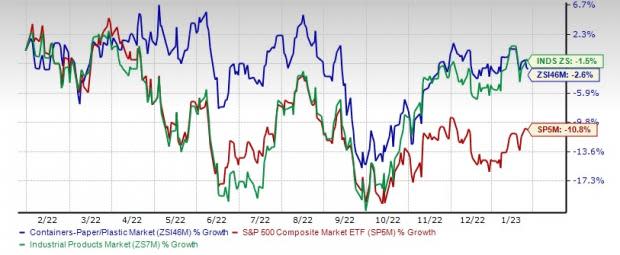

Industry Versus Broader Market

The Containers – Paper and Packaging industry has outperformed the S&P 500 but lagged the sector over the past year. The industry has fallen 2.6% compared with the S&P 500’s decrease of 10.8%. The Industrial Products sector has meanwhile declined 1.5%.

One-Year Price Performance

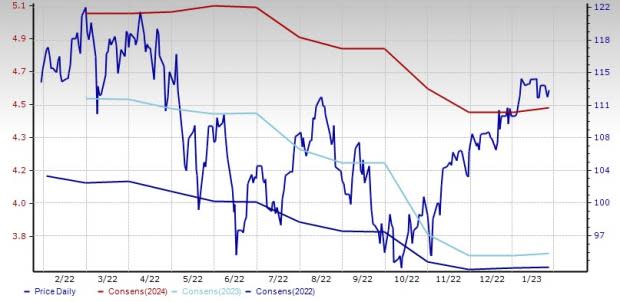

Industry’s Current Valuation

On the basis of the trailing 12-month EV/EBITDA ratio, a commonly used multiple for valuing Containers – Paper and Packaging companies, we see that the industry is currently trading at 17.03X compared with the S&P 500’s 19.73X and the Industrial Products sector’s trailing 12-month EV/EBITDA of 19.83X. This is shown in the charts below.

Enterprise Value/EBITDA (EV/EBITDA) Ratio (TTM)

Enterprise Value/EBITDA (EV/EBITDA) Ratio (TTM)

Over the last five years, the industry traded as high as 30.06X and as low as 10.95X, with the median at 16.31X.

3 Containers – Paper and Packaging Stocks to Keep an Eye on

Graphic Packaging: GPK has been capturing new business opportunities, supported by consumer preference for sustainable, fiber-based packaging solutions. Innovation and more circular consumer-packaging solutions are consistently driving its organic sales growth. GEF’s shares have appreciated 8% in the past month. The company is partnering with new and existing customers globally to fulfill their demand to package consumer goods in recyclable, fiber-based solutions. GPK is well poised to meet this increased demand for recycled content in paperboard packaging as its state-of-the-art coated recycled board machine in Kalamazoo, MI continues to ramp-up production. The machine is expected to significantly improve water and energy usage, and enable GPK to be the lowest-cost producer of high-quality coated recycled board in North America. It is expected to contribute $130 million to incremental EBITDA over three years. Graphic Packaging has been executing price actions for a while, thus aiding in offsetting commodity input cost inflation.

The Zacks Consensus Estimate for this Atlanta, GA-based player’s fiscal 2023 earnings has moved up 1% over the past 60 days. The figure indicates year-over-year growth of 9.5%. The company has a trailing four-quarter earnings surprise of 14.7%, on average. GPK has an estimated long-term earnings growth rate of 25% and a Zacks Rank #1 (Strong Buy) at present.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Price & Consensus: GPK

AptarGroup: The company’s Beauty + Home segment will continue to gain from increased demand for beauty and personal care markets. The company is investing in building a new state-of-the-art Prestige Custom beauty plant in Oyo, France, which will be operational by the end of this year. The Pharma segment is witnessing steady demand growth for the prescription, consumer healthcare and active material markets. Given the ongoing sales momentum in elastomer components and active material solutions, AptarGroup is expanding its capacity to produce elastomer components for injected medicines and active material science solutions, which will drive near-term growth. The company has embarked on a business-transformation plan that will drive top-line growth, boost operational excellence, enhance its approach to innovation and improve organizational effectiveness. Focus on acquisitions to expand the scope of technologies, geographic presence and product offerings will also aid growth. Shares of ATR have gained 3% over the past month.

The Zacks Consensus Estimate for AptarGroup’s fiscal 2023 earnings has moved 0.5% north in the past 60 days. The figure indicates year-over-year growth of 2%. This Crystal Lake, IL-based company has a trailing four-quarter earnings surprise of 0.81%, on average. The stock currently has a Zacks Rank #3 (Hold) and an estimated long-term growth rate of 7%.

Price & Consensus: ATR

Karat Packaging: The company is benefitting from robust demand for its eco-friendly products and other offerings. With growing pressure on countries across the globe to enact new regulations to ban Styrofoam and single-use plastic, the company is poised well to capitalize on increased demand for compostable products. It is planning to expand the manufacturing capacity in its Taiwan joint venture, and accelerate its initiative to build a bagasse factory in the United States in 2023, using the proprietary manufacturing processes of the Taiwan facility. KRT is implementing new initiatives to significantly boost online sales. Shift to higher-margin products, such as environmentally-friendly products will boost its margins. Pricing actions undertaken by the company to offset increased product, ocean freight and labor costs have also been supporting its margins. KRT shares have gone up 9% in a month’s time.

The Zacks Consensus Estimate for Karat Packaging’s 2023 earnings has remained stable over the past 60 days. The earnings estimate for the year suggests growth of 14.4%. KRT has a trailing four-quarter earnings surprise of 8.2%, on average. The Chino, CF-based company has an estimated long-term earnings growth rate of 10% and a Zacks Rank of 3.

Price & Consensus: KRT

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AptarGroup, Inc. (ATR) : Free Stock Analysis Report

Graphic Packaging Holding Company (GPK) : Free Stock Analysis Report

Karat Packaging Inc. (KRT) : Free Stock Analysis Report