Idaho Falls, ID – COVID-19 has drastically changed the way consumers shop for groceries. Last week, Category Partners (CP) released and discussed results in part one of a two part consumer study that explored the economic impacts of COVID-19 on what consumers are now seeking from a product value and retailer format perspective.

In part two today, Category Partners takes a deeper look at

consumer feedback as it relates to how they are navigating the retail channel

and in-store environment, purchase quantity and packaging.

Consumers’ health concerns, stay-at-home orders in nearly

every state, the closure of many restaurants and businesses and the fact that

nearly half of American households have seen a reduction in their household

income have all contributed to changes in where consumers buy groceries, how

much they buy and how they shop.

In the Category Partners’ study, one-third of consumers,

34%, said because of COVID-19 they are using online delivery more often for

their grocery purchases, and 27% are using online grocery pick-up more

often. Conversely, one-third of

consumers said they are shopping at superstores less, 29% are shopping at

supermarkets less, and about one-quarter of consumers are also shopping less at

natural/organic stores and specialty stores.

In this study, CP polled 2,000

consumers throughout the U.S., aged 18-75+ (further demographic information

below*), giving it the ability to study changes in shopping behavior across

region, age and household income.

As might be expected, younger shoppers have embraced online

grocery channel moreso than older shoppers.

Fortytwo percent of consumers younger than age 45 report using online

grocery delivery more and 33% using

online grocery pick-up more now than

before the pandemic. In comparison,

fewer consumers age 45 and older said they have increased their use of online delivery and pickup, at 24% and 21%, respectively.

Along with changes in where

consumers shop, COVID-19 continues to affect what they buy. Possibly because these items store well,

about half of consumers, 51% respectively, reported they are buying more frozen

foods and center store items. Consumers

are also buying more dairy, fresh fruit, fresh vegetables and fresh meat. By contrast, 35% are buying less seafood than

they ordinarily would. A nearly equal

number of consumers have increased the amount they purchase from the deli and

bakery departments as have decreased the amount they buy.

The study also revealed

significant differences across age groups.

Consumers under age 45 are more likely than older consumers to buy more

food from each of the grocery departments.

For example, 46% of younger respondents said they are now buying more

fresh fruit and 45% are now buying more fresh vegetables, compared to 30% and

29%, respectively, of respondents age 45+.

Likewise, 34% of those younger than 45 reported buying more dairy

products, compared to only 19% of those 45+.

Cara Ammon, Category Partners’ senior vice president, research and

market intel, noted, “This increase in

food purchases among younger consumers makes sense. Many are now working from home, or

unfortunately are at home due to furlough, and many may have children home from

school. Families have gone from eating

lunches and even breakfasts at work and school and eating many dinners on the

run to eating all of their meals at home.

That makes a huge difference in their grocery purchases.”

There are also differences by

region. Consumers living in the

Northeast and the South more often reported stocking up on items from every

department, while somewhat fewer consumers in the Midwest and West increased

their purchases from each of these departments.

In addition to

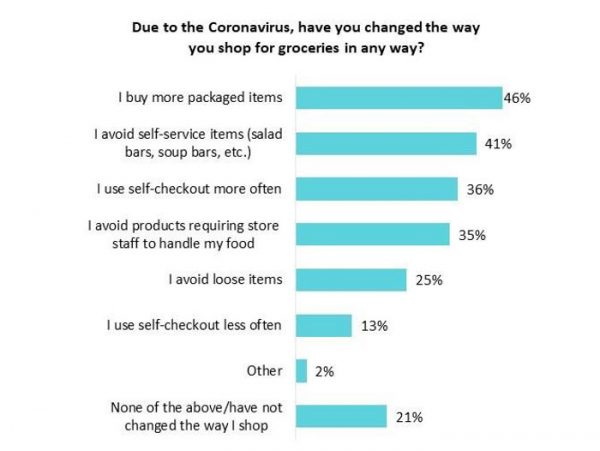

where they shop and what they buy, COVID19 has also changed how consumers

shop. One of the biggest shifts is

toward packaged items and away from items that may have been handled by store

staff. Nearly half of consumers in the

study, 46%, said they are now buying more packaged items. A significant number are also taking steps to

limit the number of people handling their food, including avoiding salad bars

and other selfservice items (41%), using self-checkout (36%), avoiding the meat

counter, deli counter and other items that require store staff to handle food

(35%) and avoiding loose items (25%).

Ammon added, “Consumers have made significant changes to just about every aspect of

their grocery shopping behavior. It will

be interesting to see how many of these changes continue once the COVID-19

pandemic is over. Some of these shopping

behaviors may be here to stay.”

The study revealed that a greater

number of younger consumers making changes to the way they shop for

groceries. Overall, 85% of consumers

under age 45 made changes to the way they shop, while 74% of consumers age 45+

have made changes. Specifically, more

than half of respondents younger than 45, 53%, said they are now buying more

packaged items, compared to 40% of those older than 45.

“This

will be a moving target,” concluded Ammon, “The lockdowns will end, the health crisis will abate and consumers

will have in-store and restaurant options once again. The larger economic pressures will linger a

bit longer. The value to retailers and

suppliers in being prepared to understand and offer solutions these consumers

seek and need cannot be understated.”

*HH income between <$25,000 and

>$200,000, encompassing various ethnicities and nearly evenly split between

female/male, release date April 20, 2020.

About

Category Partners – a nationally

recognized resource, among food companies and retailers, for delivering

actionable business/consumer insights, marketing/sales plans and

technology/data solutions. Category Partners is producer owned and

headquartered in Idaho Falls, ID, with offices in Laguna Hills, Calif.,

Chicago, and Wenatchee, Wash.

For more information, contact CP

president Adam Brohimer, at adam.brohimer@categorypartners.com.